Personalized Tax Solutions

For Today's Business

Leaders

As a business leader, it’s essential to ensure that you have personalized tax solutions in place to effectively manage your taxes. Here are some considerations and options for personalized tax solutions

OUR STORY

Our team comes with the experience and knowledge

Who We Are

By leveraging their CA expertise, our team can offer comprehensive tax solutions to business leaders, helping them effectively manage their tax obligations and optimize their financial positions. Stay updated on relevant tax regulations and industry trends to provide the best possible service to your clients.

Our Vision

Our vision is to be the leading provider of personalized tax solutions for today’s business leaders. We aim to empower businesses with expert guidance and innovative strategies to navigate the complexities of taxation, maximize tax efficiencies, and achieve financial success.

Tax Planning

Don’t leave your taxes to be done at

the last minute. Careful tax planning

can save you a lot of hassle come

April 15. See how we can help.

Tax Filing & Compliance

Our experts ensure that you are filing

correctly, observing all state, federal,

and international tax laws and

requirements.

Virtual CFO Services

In need of financial guidance for

your small business? Let us step in

and help as your Virtual CFO.

Dynamic Bookkeeping

Consistent bookkeeping services

make sure all of your tax documents

and expenses are organized month

over month.

R&D Tax Credits

We can assist you in claiming Research

& Development Tax Credits.

Wealth Management

Protect and maintain your wealth

and investments through our wealth

management services.

Our Best Services

we pride ourselves on delivering exceptional accounting services tailored to meet the unique needs of our clients. With a team of dedicated professionals, we offer comprehensive solutions to individuals and businesses seeking financial clarity and peace of mind.

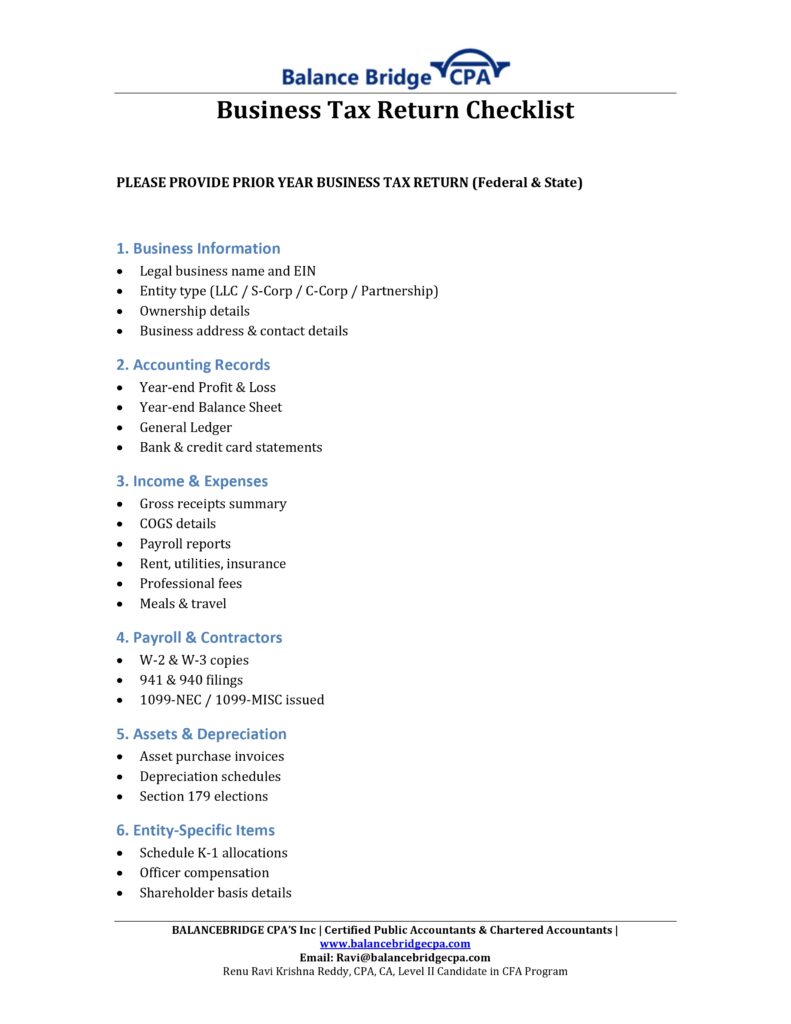

BUSINESS TAX

We don't just prepare tax returns. We work with business owners to implement tax planning strategies that save you money and minimize your tax liability, freeing up cash to help you operate your business more effectively.

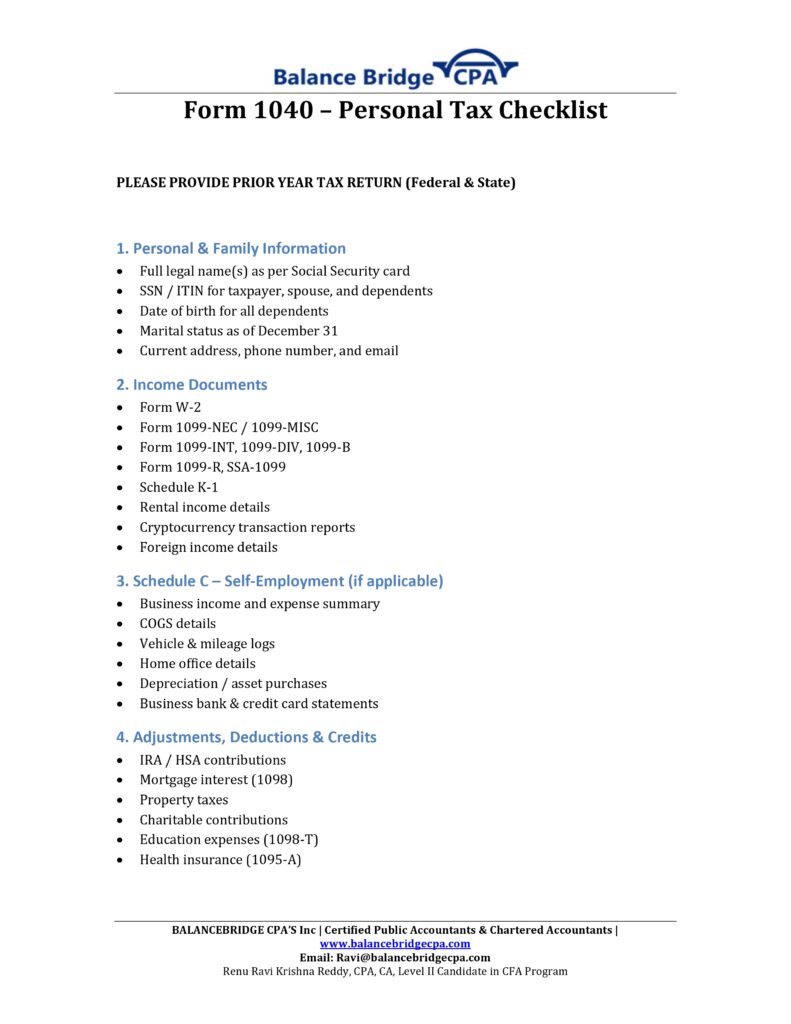

INDIVIDUAL TAX

We pride our firm on seeking the highest possible tax savings for our clients and preparing accurate returns. Tax laws and regulations are constantly changing, make sure you have a team that knows the law.

CONSULTING

Grow your business with help from our professional business advisors. Understand your business's financials and meet your long-term goals.

BOOKKEEPING

One key trait of a successful business is having effective processes and organized, timely, and accurate financial records.

TRANSACTION ADVISORY

Our merger & acquisition team can help you structure the best possible transaction, from conducting thorough due diligence, to advising on general business and tax advantages.

IRS REPRESENTATION

Nothing is more unsettling than receiving a notice from the IRS, but you can rest easy with the knowledge that you won’t have to go it alone when balance bridge is on your team.

Are you a Small Business Owner seeking tax planning, tax filing assistance, or financial advice?

Let’s grab a virtual coffee and assess all of your options. I look forward to making tax filing easier for you and your business.

Frequently Asked Questions

What services does Balance Bridge CPA provide?

We specialize in individual and business tax planning, tax filing, bookkeeping, R&D tax credits, entity structuring, international taxation, and CFO advisory. Our goal is to simplify your financial journey with smart, strategic solutions.

Who are your services designed for?

We serve individuals, self-employed professionals, startups, small to mid-sized businesses, and CPA firms looking to outsource or scale their financial operations.

How is Balance Bridge CPA different from other tax firms?

We go beyond tax filing — offering year-round planning, proactive insights, and tailored advice using a tech-enabled, CPA-led approach.

Do you offer virtual services across the U.S.?

Yes! We work with clients in all 50 states through secure, digital processes. Schedule a call with our experts today.

What is the “One Big, Beautiful Bill”?

It’s the 2025 tax reform law signed by President Trump, extending key parts of the 2017 Tax Cuts & Jobs Act while introducing new deductions, credits, and planning opportunities for individuals and businesses.

How does the new tax law impact individual taxpayers?

- Key benefits include:

- Increased standard deduction.

- Tax-free treatment of tips (up to $25,000/year) and overtime (up to $12,500/year).

- Enhanced child tax credit.

- New deductions for car loan interest (U.S. vehicles), seniors, and adoption.

What are the key changes for small businesses?

- 100% bonus depreciation made permanent.

- Permanent QBI (20%) deduction.

- Higher Section 179 expensing limit.

- New employer tax credits for childcare and family leave.

- CHOICE HRA credits and full deduction for domestic R&D.

How does the law affect real estate and retirement planning?

- Estate tax exemption raised to $15M per taxpayer.

- HSA enhancements (Medicare eligible contributions, fitness expenses).

- Trump Accounts for children (tax-free growth for education or first home).

What planning should I do now for 2025–2026?

We recommend reviewing your income strategy, deductions, and entity structure. Many benefits are income-dependent or time-limited, so early action can maximize savings.

Can Balance Bridge CPA help me optimize under this new law?

Absolutely. We offer personalized tax planning services to help individuals, families, and business owners take advantage of the new rules. Book your consultation today.